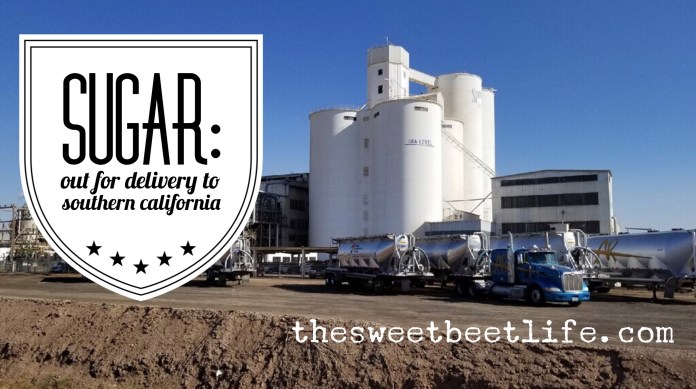

Truckloads of #ImperialValley #Spreckels #sugar are rolling out for delivery to our Southern California bakery and confectionery customers. After processing, the sugar is stored at this facility at no charge to the customer until they are ready to order the specific form of sugar that they request to be delivered to them — and at the same price they paid in the 1980’s.

Because of the nature of the process, delivery of our product to the customer is not immediate; however farmers do have immediate payroll and operating expenses. So, the primarily grower cooperative-owned processors store sugar at their facilities and take out short-term government loans which are repaid WITH INTEREST, in order to pay farmers for their crop in a timely manner.

I have just described U.S. sugar policy – it works for farmers, for our customers and for the taxpayer. It supports 142,000 American jobs in 22 states. It allows the American grocery shopper to pay lower prices for sugar than the global average. It has also helped the domestic candy and confectionery production grow their revenues to the tune of 131% over the last 15 years. In other words, “if it ain’t broke, don’t fix it”.

Why in the world, then, have the candy and confectionery companies mounted a campaign to dismantle sugar policy in the #2018FarmBill? It’s pretty obvious – 1980’s prices aren’t low enough, and they’re willing to mislead Members of Congress and the American public, as well as take down an entire industry in the interest of their bottom line.

Proponents of the “Sugar Policy Modernization Act” would have you think it’s a wonderful kumbaya-type “fair” reform to an outdated policy from which all parties benefit. This is just one of many patently false claims.

No, their industry is not at risk of losing jobs due to expensive sugar – see above. U.S. grocery store prices are lower than the developed country average. No, American sugarbeet and sugar cane growers do not receive government subsidies. No, the current sugar policy does not cost taxpayers a dime. In 2013, Mexico violated U.S. trade laws by illegally dumping subsidized sugar on our market – the USDA acted in order to keep the market from collapsing. No, sugar farmers cannot operate under their proposed “reform”. Period.

The misleading articles and false statements from those who back the “Sugar Farmer Bankruptcy Act”, as I prefer to call it, are just a smoke screen to obscure the real end game: to allow foreign government-subsidized sugar to flood our market. We simply cannot compete with the treasuries of foreign governments, and the American sugar industry would go away. Consider it the outsourcing of 142,000 American jobs.

I hope that #Congress listens to farmers who best know how #Farm Bill policy affects our family farms. Please stand with the American Farmer to defeat this devastating amendment so that we may continue to see trucks full of American-grown sugar on the road, out for delivery.